A payslip is a critical paper that should be provided to employees on salary day with salary. Some companies didn’t offer payslips, so in that case, the employee should ask for any prove like a salary certificate.

Apart from casual life, expressing each and everything in documented form becomes necessary when you enter professionalism. This also includes salary slip, because it is proof that salary has been given from the employer to its employee. The simple salary slip format in excel free download contains a complete figure about the salary drawn and written in the specific documented form. You can also print this excel slip for that purpose you can read this guide.

Salary slip is defined as:

A payslip or salary slip is a hard copy or soft copy document given to the employee from the employer. It is a sort of record containing salary components like deductions and allowances. The employer can mail, deliver this payslip electronically, or be given a hand to hand from the employer to its employees. And if you didn’t get the payslip, it is your legal right to ask for it. So you can make sure that the proper amount of salary has been given to you or not?

Why is the salary slip important?

Well, a salary slip is essential because it is a document either in the form of hard copy or soft copy:

- It proves that the employee has been given the salary from the draws of business.

- Moreover, a payslip is needed as a significant report when any person applies for a loan.

- When you request in any financial institution, they ask you for the monthly salary slip format free download pdf to continue the further procedure.

- According to the financial establishment, a payslip is a confirming document of how much the candidate’s budget is?

- You can know the credit limit of the individual.

- A payslip contains all the authoritative records of a person.

- To avoid future hassles, the payslips should be stored legitimately.

What are the benefits of a salary slip?

A salary slip is usually proof of your income, containing many benefits, which are listed below:

Proof of employment:

Payslips are said to the legal proof that you are associated with any organization. So if you apply to any university or for a visa, your salary slip will be needed to confirm your employment and source of income.

Income tax planning:

Payslip contains tax-deductible components, so it will become easy to calculate how much tax you have to pay and in calculating the tax returns and refunds.

In financial institutions:

If you apply for any type of loan, credit cards, or any legal procedure, they will ask for the payslip to assure your income.

Salary negotiation:

Your salary slip from the previous organization can help you ask for a better package in the future organization.

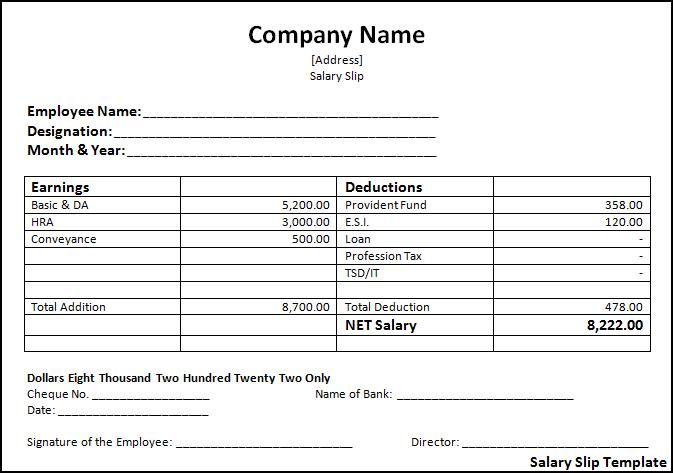

Components of the salary slip

There are various formats of salary slip format in excel, pdf free download which depends upon its components. That is listed below:

1: Salary and Allowances:

- Basic salary: The most important component is the basic salary. All the other depends on it and it 30% to 40% depends upon the take-home salary.

- Allowances: These are the organization’s benefits with the employees’ basic pay to meet their personal expenses.

Types of Allowances:

- Conveyance Allowance (CA): It is also called travel Allowance, which includes home to work or work to the home expense. In actual this includes the expense for the work-related travel plans or the field trips.

- House Rent Allowance (HRA): It is the part of 40% to 50% of the monthly salary and depends upon your rented house’s location. These components can be said as the tax deduction component.

- Dearness Allowances: While filling the income tax returns, it must be declared as it is completely taxable.

- Medical Allowance: This is paid to the employees monthly as the expenses to solve their health-related problems.

- Performances Allowances: This is paid according to the employee’s monthly performance. You can consider it as a bonus, appraisal, or incentives.

2: Deduction:

Several components are deducted from the monthly salary. These components are founded under the deduction section of the payslip.

- Income tax deduction: Every month, a certain amount of tax is deducted from the take-home salary. It depends upon the fixed amount suggested by the income tax department.

- Employ provident fund (EPF): 12% of the employee’s salary is deducted for employing a provident fund.

- Professional tax: A fixed amount is deducted from the salary and paid to the government.

As I told you about any salary slip components, there are formulas to calculate each component perfectly. All the formulas with the components are written below:

Taxable income:

To calculate how much amount from your salary is deducted to pay the text, here is the formula:

- Income (Gross salary + Other Income) – deductions.

The total salary package of the employee (CTC):

This formula helps you to know the perfect amount of salary the organization is giving to you; the formula is:

- Gross salary + PF + Gratuity

Gross salary:

This is the total amount of salary without any deduction, and you will calculate it through:

- Basic salary + HRA + other Allowances

Net salary:

Net salary is the remaining amount after all the deduction; you can say that this is the take-home salary. And you will know this through the given formula:

- Basic salary + HRA + Allowances – income tax – Employers provident fund – professional tax.

Conclusion:

The simple salary slip format in word free download is an essential legal document as it has a lot of importance and benefits. So it’s completely legal to ask for the payslip forms your organization. If you have it, you can know that are you given the right amount of salary? How much bonus do you get? And how much salary is deducted in different components? There is much organization who gave a hard copy of payslip to their employees or some organization send the payslip via mail, or electronically. The employee should have its payslip either in the hard or soft copy to be saved from future problems.